The influence of Net Interest Margin1 (NIM) on credit lending2 has long been a widely discussed topic. A consistently healthy NIM is vital because it provides banks with the necessary buffer to absorb credit risk, thus encouraging a greater capacity and willingness to lend, particularly to segments perceived as riskier. Conversely, shrinking margins often signal systemic pressure, which compels banks toward a cautious and risk-averse lending posture.

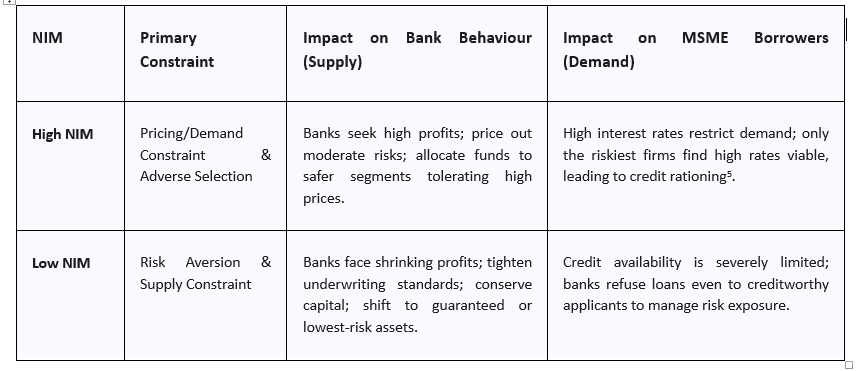

NIMs are expected to be negatively related to bank credit3. However, a comprehensive analysis of this relationship reveals that the influence of NIM on credit supply, particularly to economically vital yet vulnerable sectors like Micro, Small, and Medium Enterprises (MSMEs), is not direct or linear. Both extremely low NIM (margin scarcity) and excessive high NIM (margin excess) can impose distinct constraints on the flow of financing to the real economy.

Impact of NIM on Credit Lending

Micro, Small, and Medium Enterprises (MSMEs) are vital to India’s economic growth and job creation. Their access to credit is influenced strongly by the behaviour of banks, which is in turn affected by their NIM4.

When NIM is High, Banks enjoy strong profits that lead to greater capacity and willingness to lend. The possible positive effect is that banks lend more to MSMEs and higher-risk borrowers since profits provide a cushion for losses. However, if high NIM comes from costly lending rates (high interest rates charged to borrowers): MSMEs face expensive borrowing costs due to their limited collateral, and their higher risk profile leads to reduced credit demand from MSMEs. Banks may prefer to allocate funds to safer loan segments such as retail or large corporates, resulting in limited credit flow to MSMEs.

In a period when NIM is Low, Banks face shrinking profit margins, which leads to cautious lending behaviour. Banks tighten lending standards to manage risk and prefer safer investments and loans. As a result, credit growth to MSMEs slows down because MSMEs are generally riskier clients.

Table 1: Differential Constraints of NIM Extremes on MSME Credit Flow

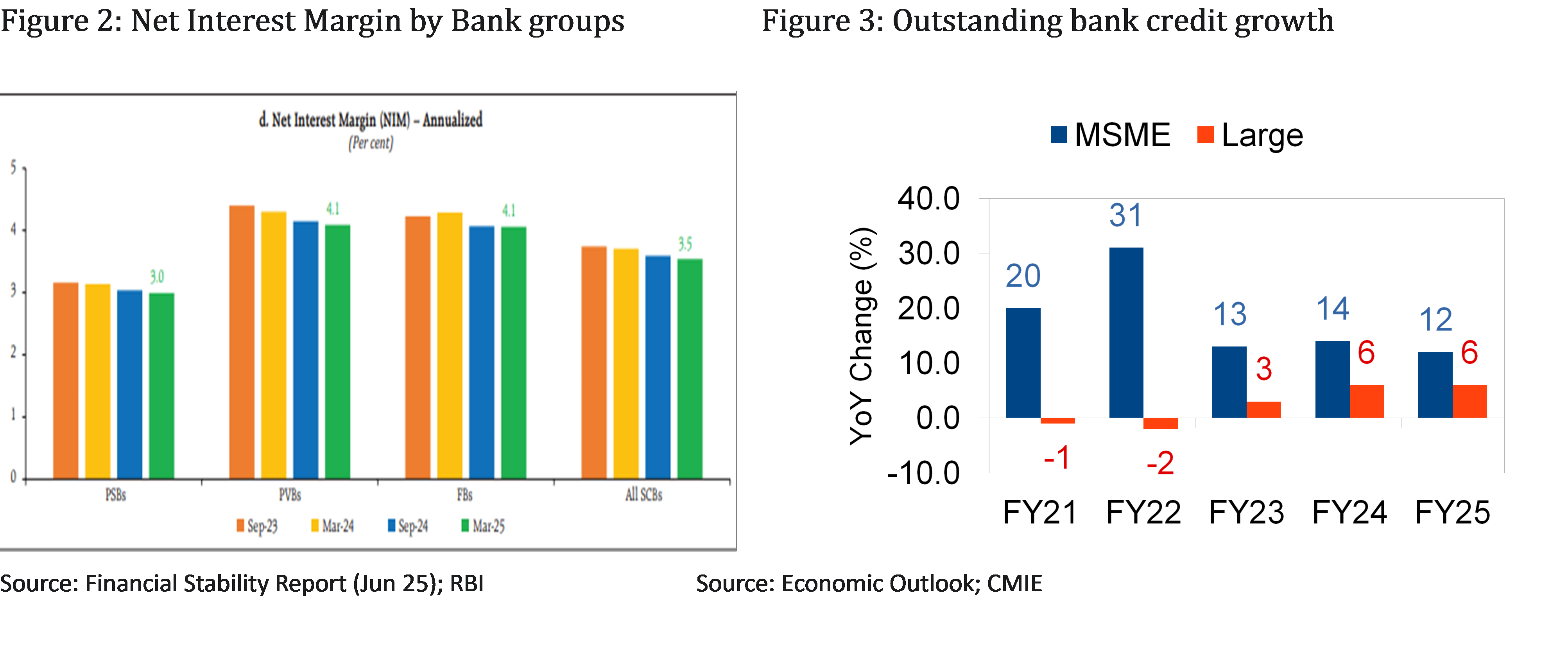

Current State of SCB NIM and Structural Gaps

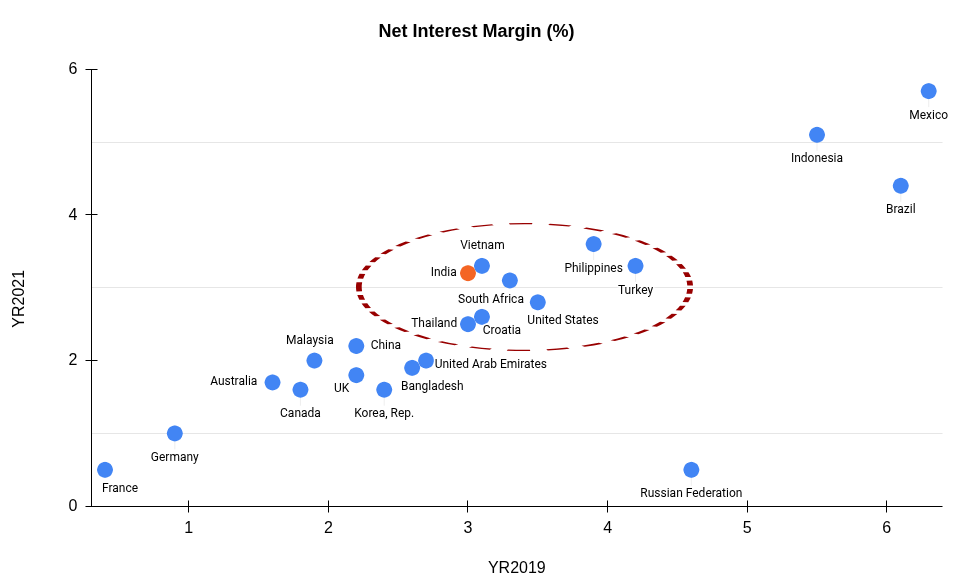

Data for SCBs confirms a recent trend of NIM compression. As of March 2025, the annualised NIM aggregated across all SCBs stood at 3.5% . This represents a decline from the 3.6% recorded in September 2023 and a more significant decrease from the recent peak of 3.7% observed in March 2023. This NIM range, hovering between 3% and 4%, aligns with typical margins seen across major developing economies, contrasting sharply with the below 2% margins often recorded in advanced markets.

Figure 1: Net Interest Margin by Countries

source: world bank

NIMs in the Indian banking system often appear higher compared to those in highly developed economies. This structural profile is partially attributable to regulatory requirements, such as Statutory Liquidity Ratio (SLR) and Cash Reserve Ratio (CRR), which require banks to hold certain proportions of assets as lower-yielding mandated securities.

Within the Indian banking system, a pronounced structural divergence persists. Private Sector Banks (PVBs) recorded an average NIM of 4.1% as of March 2025, maintaining a gap of nearly one percentage point over Public Sector Banks (PSBs), which recorded 3.0% This differential reflects variations in operational efficiency, risk appetite, and deposit franchise strength between the two cohorts.

Contrast this to the credit flow to the MSME sector, which accelerated robustly, growing at an annual growth rate of 18% between FY 2020 and 2025. This growth rate surpassed that of retail loans (17%) and services sector lending (14%). This reflects a critical divergence from the low-NIM risk aversion theory.

This resilience in MSME lending, against the backdrop of shrinking profitability, is attributable not to market-driven NIM expansion but to deliberate regulatory redirection of capital. The possible explanation can be attributed to two simultaneous regulatory actions:

- Increasing risk weights on unsecured retail segments, such as personal loans and credit cards, making them capital-intensive and less attractive.

- Besides, this bank has been slashing MSME rates amidst fierce competition, and better use of digital underwriting has helped improve the credit deployment better.

- The growth in MSME credit has persisted despite a broader slowdown in overall bank lending, supported by improvements in asset quality. The gross non-performing assets (GNPA)6 ratio for MSME loans declined from 4.5 percent in March 2024 to 3.6 percent in March 2025. In addition, the share of subprime borrowers dropped significantly—from 33.5 percent in mid-2022 to 23.3 percent as of March 2025.

In the Indian context of 2025, fluctuations in NIM due to funding costs, competitive deposit markets, and regulatory changes directly influence credit availability. While healthy NIMs enable robust lending to this critical sector, extremes in margin levels—both high and low—can constrain MSME access to affordable financing. In their 1981 paper "Credit Rationing in Markets with Imperfect Information," Stiglitz and Weiss argued that asymmetric information in credit markets prevents equilibrium via higher interest rates: such hikes attract riskier borrowers (adverse selection) and incentivize shirking (moral hazard), prompting lenders to ration credit instead. This framework fits India's NIM paradox, where margins have compressed to 3.5% as of March 2025 amid deposit competition and regulatory pressures, fostering risk-averse underwriting that should throttle lending—yet MSME credit surges 18% annually since FY2020.

[1]Defined as the annualised difference between the interest income banks generate from their loan assets and the interest expenses they incur on their funding base (primarily deposits), expressed as a percentage of earning assets

[2]Agarwal, Sumeet & Rai, Aditya (2025) Exploring Loan Growth Determinants of Indian Banks Listed in The Nifty Bank Index, South India Journal of Social Sciences. (Vol.23 No.2)

[3]Tan, M. T. B. P. (2012). Determinants of credit growth and interest margins in the Philippines and Asia. International Monetary Fund.

[4]NIBM WORKING PAPER SERIES RBI's Recent Monetary Policy Tightening and its Impact on Money, Bond and Credit Markets Jiji T Ma - National Institute of Bank Management, accessed November 4, 2025, https://www.nibmindia.org/static/working_paper/NIBM_WP37_JM_XAV1L4X.pdf

[5]Stiglitz, J. E., & Weiss, A. (1981). Credit rationing in markets with imperfect information. The American economic review, 71(3), 393-410.

[6] https://www.mmindia.co.in/article/2990/msmes-emerge-as-catalyst-in-growth-for-bank-credit-in-fy25

( The author gratefully acknowledges NIPFP Professor Dr Lekha Chakraborty’s valuable comments and guidance.)