(Co-authored with R. Kavita Rao)

Trends in corporate investment

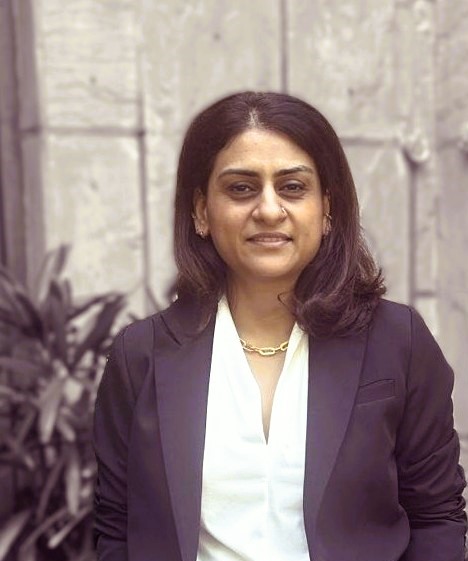

Indian policy makers are focused on addressing slowdown in private investment. As increase in investment can spur long term growth. In terms of composition, share of private non-financial corporate investments in gross capital formation remained largely unchanged in the last decade, hovering around 35%. This is accompanied by the levels of gross capital formation (31.4% in 2023-24) which are at levels below those previously observed in 2012-13. The numbers for new investments announced and projects completed corroborate the story of slow private investments – value of new projects announced surged in the post covid period, but value of projects completed fluctuates around Rs 60 lakh crore. (see Figure 1).

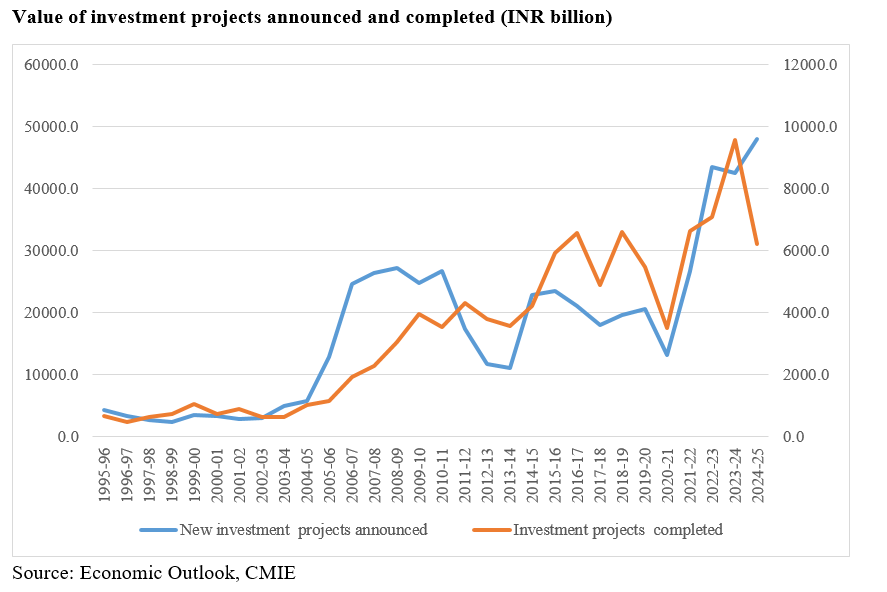

Policy measures in the past have been used as stimulus for private investment. Yet, evidence does not convey measurable success. The corporate tax reform of 2019 that removed tax incentives while offering a lower rate was received well. The statement of revenue foregone suggests that many large corporations did opt for the new regime. In 2022-23 total taxable corporate income covered under the new tax regimes (Section 115BAA and 115BAB) was 58.17%1. There is some increase in the values of projects announced and completed. Alongside, the share of investments, reserves and funds in total assets too picked up for select companies2. However, the share of net fixed assets in total assets declined. This indicates that the corporate tax cut would have provided surplus to companies but they chose to invest these in assets other than plant, machinery and other physical assets

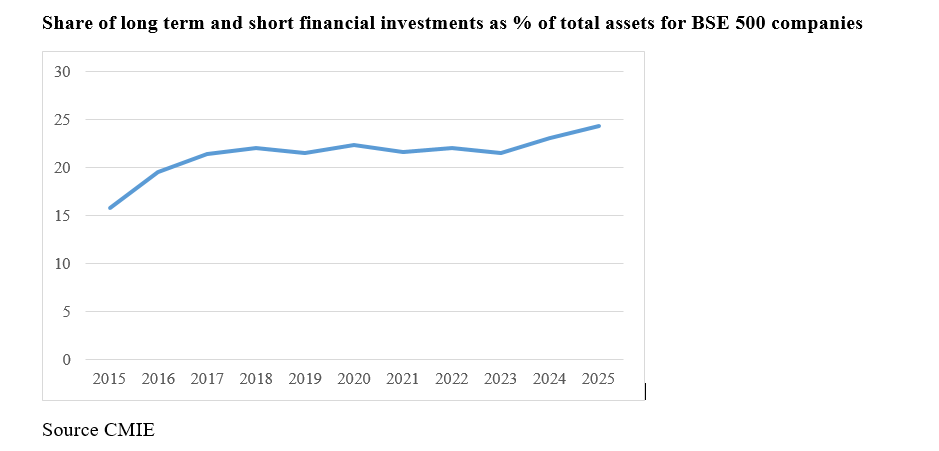

Did such change lead to higher financial investments for firms? In the case of BSE 500 companies there is an increase in the share of financial (long term and short assets) investments in total assets over the last decade, more so after 2023. In fact, in 2025 a quarter of the assets were financial investments for these companies.

Why we observe these trends?

Thus a question often asked is why corporate investments are not picking up despite the incentives. Many factors are at play. We explore some possibilities here. One consistently articulated concern is inadequate growth in demand. Slow growth in demand and excess capacity could limit the need for capacity creation or augmentation. The RBI surveys of companies suggest that average capacity utilisation fluctuates around 75 percent. Significant step up in capacity utilisation could trigger an increase in investment. This indicator does not suggest any change in the context from the demand side.

Another dimension which could influence decisions relates to technology. Two examples to consider relate to developments in artificial intelligence and green technologies. Rapid changes in technology can create anticipation of new developments. Investment decisions by firms could then become sluggish – firms could delay investment and technology choices to reduce the possibility of redundancy and obsolescence.

Another element to derive from technological progress is the possibility of a reduction in the gestation lag of investment – adoption of digital technologies could support accelerated planning and execution and improvements in efficiency of execution with automation and robotics could reduce the time taken from design to execution. It is not clear how this might be playing out in the Indian context, but it could be a factor to consider.

A third dimension to consider is perceived uncertainty in the need and scope of green compliances. With rapidly evolving compliance framework and adoption of new standards, it be important to consider whether there is an incentive to delay investments for more clarity.

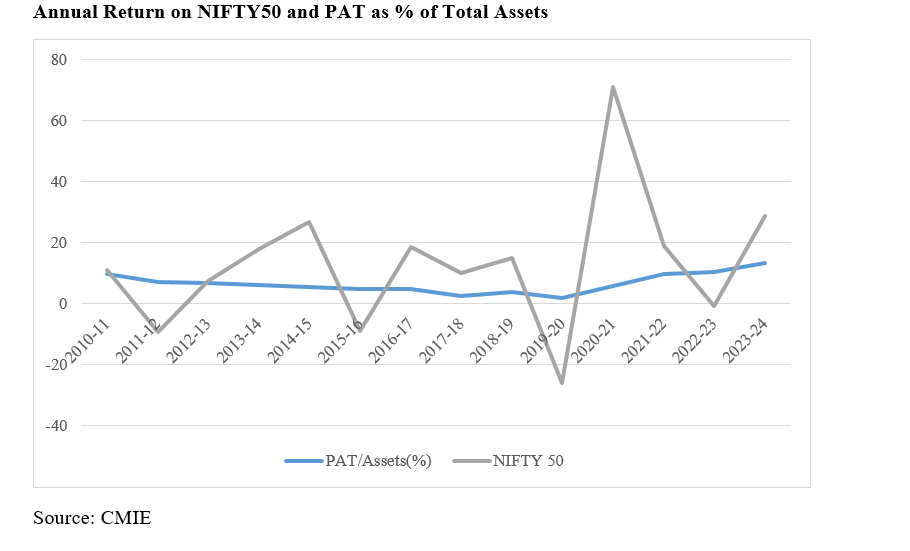

Apart from these larger questions, another practical issue to consider is the impact of performance of financial markets. The decision to invest in financial instruments could be driven by the fact that the average annualised return in the past decade on BSE Sensex and NIFTY 50 has been in excess of 10 per cent. Looking at the trend in returns of NIFTY 50 stocks and the PAT as % of assets, the former exceeded the latter in most years, except where there are large external shocks. For example, in 2010-13(global financial crisis), 2019-20 (Covid crisis) and 2022-23 (Russia-Ukraine war) exceptional global developments impacted Indian equities market. Financial investments could therefore help counter some of the slowdown in profits, which in turn could reduce the incentive to invest in fixed assets.

Finally, the recent changes in the economic environment, will augment these uncertainties. Foremost among them is the state of international economic relations in 2025. Current uncertainties in international trade have put businesses in a fix on whether they should expand their operations. The October 20253 World Economic Outlook cautions that trade uncertainty ‘weighs on firms’ investment decisions’ which dampens the growth prospects. Export oriented enterprises would be cautious of expanding capacities in such an environment. The GST reforms introduced in September 2025, are expected to provide a fillip to demand, perhaps countering some of this stress. Any significant stimulus to demand could be crucial to changing this narrative.

[1] Computed from incomes reported under section 115BAB, 115BAA and total corporate incomes in allrec.pdf

[2] These are companies selected by CMIE for reporting on corporate sector in the economic outlook

[3] World Economic Outlook, October 2025; Global Economy in Flux, Prospects Remain Dim