[Co-authored with R. Kavita Rao]

Tax compliance, i.e. filing of return and the declaration of income for tax, is the outcome of complex interactions between the measures adopted by the income tax department and the inherent beliefs of the taxpayers. Focussing on the latter, in 2015, we conducted an online survey to assess the perception of taxpayers. The main purpose of the survey was to understand taxpayers’ perceptions of the process of filing returns, institutional quality and the purpose for paying taxes. The survey of 202 online participants consisting of five questions assessed these aspects.

Compliance in filing of returns can be affected by the perceived complexity of the process, which may lead to the individuals not filing a return in spite of tax being withheld at source. The government has strived over the years to ease the process of filing, by simplifying some of the forms and by introducing e-filing. So, in order to assess whether such simplification of process has altered the perceptions of taxpayers, two questions were put forth. First, who filed their returns for them? i.e. did they file the return themselves or relied on professional help? Second, the respondents were asked what they think of the process of filing, i.e. do they think the process is simple, difficult, time consuming or costly? 61 per cent of the respondents reported relying on professional assistance of a chartered accountant or a lawyer for the filing of returns. Further, only a third (32.7 per cent) of the respondents thought that the process was simple. Others thought of it as difficult, costly and/or time consuming. Even for those who self-file returns, only half think that the process is simple. Therefore, even with the introduction of reforms in the process of filing, it is still not perceived as simple.

An individual’s decision to declare income and pay taxes is based on his/her perception of the functioning of the Income Tax Department. In order to assess the perceptions the following questions were asked- - a) what s/he thought was the information available to the income tax department, i.e. full incomes or only that declared in the return; b) in the event of being audited would s/he have to pay a penalty or possibly bribe or alternatively nothing.

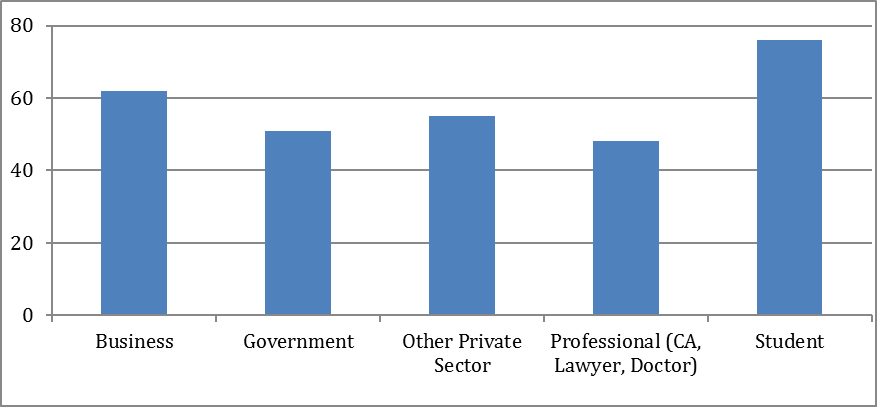

If the taxpayer believes that the information available to the department is limited to that furnished in the return, then the taxpayer would be tempted to report lower incomes. However, the second question is related to the perceived consequence if evasion is detected by the tax department, If the taxpayer believes that even on being caught for declaring less than actual or full income s/he can take recourse to bribe or that no punitive action may be taken against non-compliance, then the taxpayer may declare lower levels of income. The responses to the two questions throw up some interesting results. While 57 per cent of the respondents believe that the department has information only on the incomes they declare in the tax returns, only 30 per cent believe that bribe is a recourse available upon discovery of evasion. One would think that the individuals working within the government sector would have a fair sense of the kind of information that is available to the department, it is striking to find that half of those employed by the government think that the only information in possession of the Department is that reported in the returns (Figure 1). Therefore, we can infer perceived institutional weakness with regard to information collection.

Figure 1: Proportion who believe the tax department does not have full information (%)

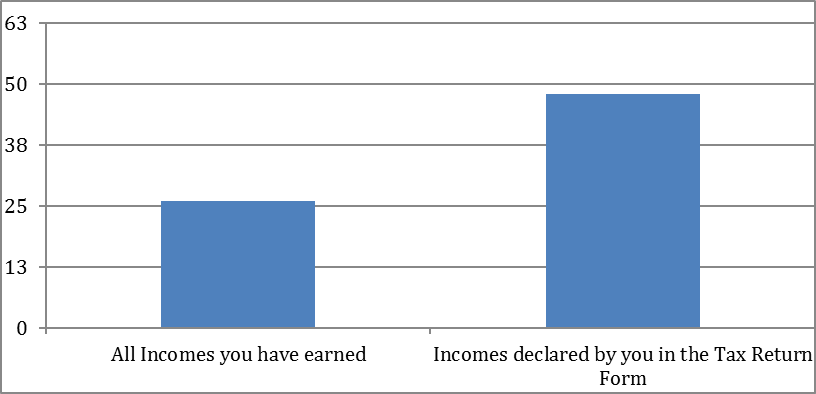

Further, it is possible that the two perceptions of institutions are related, that is those who believe that the tax department has limited information may also be likelier to believe that no punitive action will result from being caught. We take the proportion of those who believe no penalty will result for the perceptions of information available to the tax department. From Figure 2, it can be seen that the share of individuals who believe that no penalty would have to be paid on being caught is higher for those indicating that the tax department has information only to the extent of incomes reported in tax returns.

Figure 2: Proportion who think that a penalty will not be levied

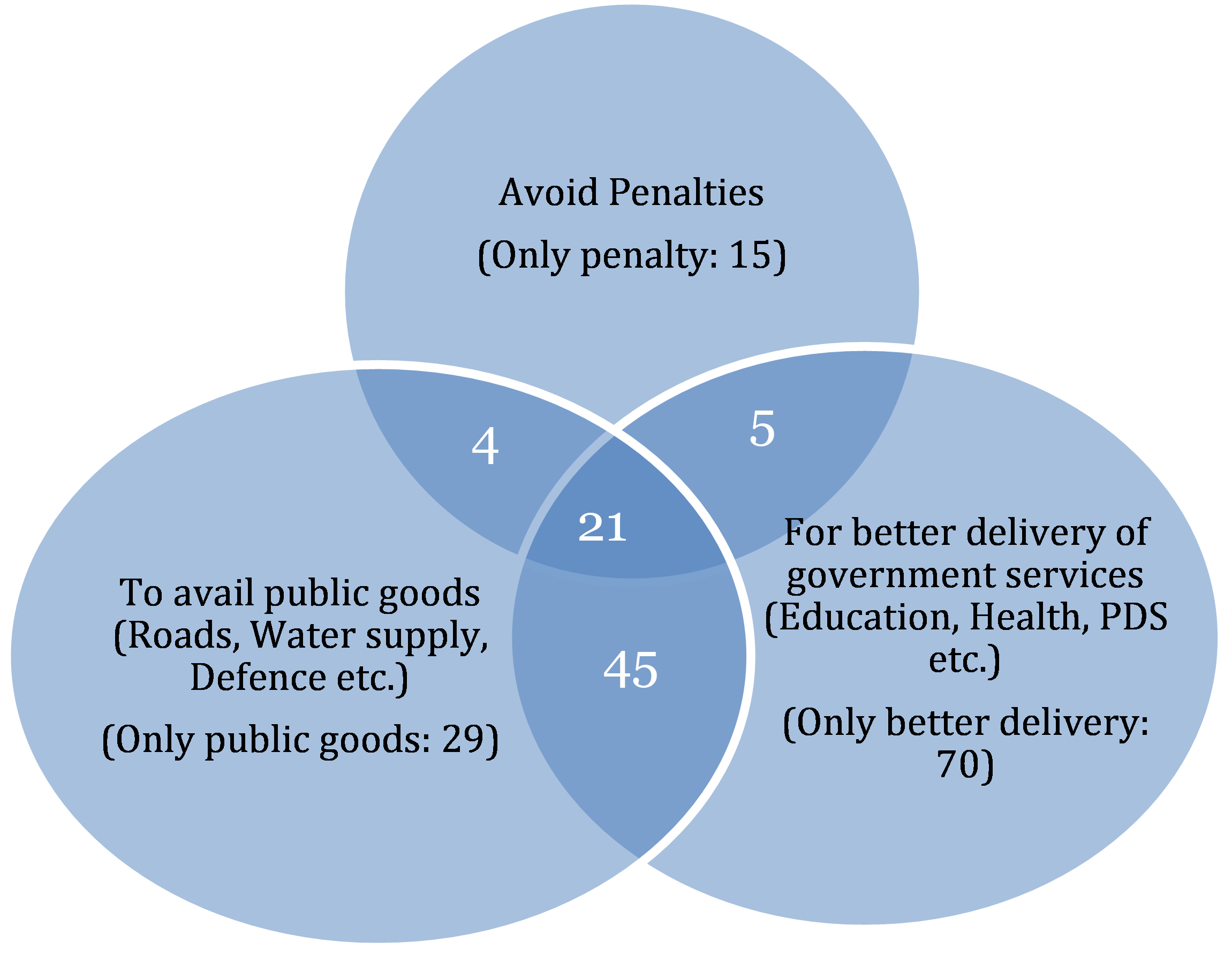

Lastly, there exists a strand of literature that correlates compliance with the outcomes on the expenditure side i.e. public provision of goods and services, i.e. the taxpayer may be more willing to pay taxes when the goods and services provided by the government are thought to be commensurate. The last question in the survey asks the respondents why taxes should be paid. The choices available were: to avoid penalties, never, for better delivery of public services and to avail public goods. Among these the respondents were allowed to select multiple options. Even though the respondents were allowed the option, only 8 respondents chose to respond with taxes should never be paid. Further, there is an overwhelming response in favour of better service delivery and this is true across all income groups. 70 per cent of the respondents think that taxes should be paid for better delivery of social services. Figure 3 provides a snapshot of the responses.

Figure 3: Why should people pay taxes (numbers of respondents)

The results from the survey indicate that the process of filing of returns is still not considered simple. This, in fact, may be the cause for the general preference for professional assistance observed among the respondents. As for the perceptions of the institutions, while a wide range of information is available to the tax department which, in turn, is utilised for detecting evasion, majority of the respondents think that the department has access to information limited to the returns. Such priors also adversely impact the perception of whether detection of evasion will result in penalties. Although, those who think of bribe as a recourse constitute a small fraction, it might be useful for the department to improve the impression of their functioning. While all the issues mentioned so far are restricted to the individuals’ interaction with the tax department, the last result underscores the impact that the overall performance of the government can have on compliance. The fact that a small fraction think that taxes should not be paid and most believe that the taxes should fund better service delivery implies that with discernible improvements in the effectiveness of service delivery, the perceptions about willingness to pay could be a possible measure to improve compliance.

Dr. Suranjali Tandon is Consultant and Dr. R. Kavita Rao is Professor at NIPFP, New Delhi.

The views expressed in the post are those of the author only. No responsibility for them should be attributed to NIPFP.